Read Time: 10 minutes

Table of Contents

Introduction

The global insurance BPO market is booming and expected to cross $12 billion by 2034, according to Global Market Insights. That growth reflects a broader shift: insurers are outsourcing not only to cut costs, but to also move faster and scale smarter.

In simple terms, insurance BPO is when a third-party takes care of key tasks like claims handling and underwriting support. The benefits of BPO for insurance companies is that these partners can do the job more efficiently and cost less, which helps your internal team focus on higher priority tasks.

However, it gets tricky because not every outsourcing model works for every company. The wrong fit will create more problems than it solves which is why it’s crucial to select the right type of BPO model for your organization.

This guide is here to help you navigate to the right BPO model by showing you what to look for and pointing out red flags too.

Key takeaways

- A breakdown of the main insurance BPO models, Functional, End-to-End, and Staff Augmentation/Hybrid, with their core strengths and limitations.

- How to match a BPO model to your business type (carrier vs agency vs MGA).

- A review of critical factors to evaluate when considering a BPO provider.

- Key questions to ask BPO providers.

What Is Insurance BPO Today?

Insurance BPO has come a very long way from its early days of transactional support and offshoring. These days, it’s more like a high-value strategy that enables insurers to do more. The decision to outsource is about accelerating performance. In this section, we will explore how insurance BPO has transformed from a back office solution to a driver of innovation and customer satisfaction.

From Cost-Cutting to Strategic Enablement

At its core, insurance BPO refers to the practice of contracting third-party vendors to handle specific business functions. It is often viewed as a cost saving tactic that focuses primarily on back-office operations.

However, the business process outsourcing insurance industry has evolved. The best insurance BPO companies now offer advanced capabilities such as:

- Digital tools

- AI-based automation

- Analytics

- Customer experience management (CXM)

These services do so much more than just cut costs. They help improve agility, scalability, and also innovation.

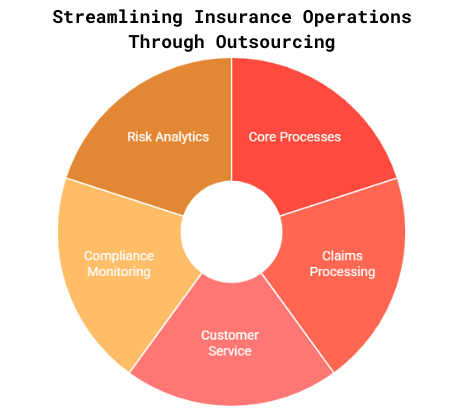

Types of Insurance BPO Services: What You Can Outsource

Insurance BPO is all about finding better ways to serve policyholders while reducing strain on internal teams. Insurers are outsourcing way more than just admin tasks these days and the scope of what can be outsourced continues to grow.

Core vs Non-Core Insurance Processes

Core processes like policy administration, claims management, and underwriting support are all central to how insurance companies operate. These often have high volumes of data, regulatory sensitivity, and tight deadlines. Outsourcing can take away some of the strain that comes from these and insurers can focus more on product development and market growth.

One of the most popular functions to outsource is insurance BPO services for claims processing. Claims intake, documentation review, data entry, claim adjudication, and customer service, if handled improperly, can cause delays and errors. Insurers can avoid this and help maintain customer satisfaction by outsourcing these functions. These trained professionals will have the advanced tools and scalable resources to streamline processes.

Things like customer service, compliance monitoring, and risk analytics are also great for outsourcing. While these functions still require expertise and consistency, they don’t necessarily need to live in-house. Handing them off to a trusted partner is the way to go if your company needs to free up internal teams.

Industry-Specific BPO (P&C, Life, Health)

There are a variety of insurance operations that have different needs. For example, life insurers face unique policy complexities, while health insurers must handle sensitive claims data with speed and compliance. BPO providers offer specialized solutions tailored to each sector.

Life insurance BPO solutions help improve processes like underwriting and policy servicing with an emphasis on compliance and customer care. End-to-end insurance BPO solutions in P&C and health cover everything from first notice of loss all the way to renewals. This helps carriers improve consistency and customer experience across the policy lifecycle.

BPO Delivery Models Explained: Which One Fits Your Business?

The right delivery model will depend on our organization’s size, growth stage, internal capabilities, and strategic goals. Finding the right method for your business doesn’t have to be difficult. Let’s break down a few of the most common options.

Functional BPO

This model involves outsourcing a single function such as claims management or policy administration. This is ideal for smaller agencies and firms that want to test out outsourcing without fully committing to it. Functional BPO can provide immediate relief for overloaded departments looking to drive cost savings. Another benefit is it allows companies to outsource on a smaller scale, helping them build trust with a provider before potentially expanding the partnership.

Functional BPO gives teams the ability to focus on what they need to without sacrificing efficiency. It’s a smart entry point for insurance operations that are looking to gradually scale their outsourcing strategy.

End-to-End BPO

As the name suggests, end-to-end BPO covers everything from new business intake and underwriting, to renewals and customer service. It is a great option for large carriers looking to streamline operations at scale. End-to-end providers will often bring more advanced tools and processes that elevate the customer experience across the entire policy lifecycle.

This model creates a single point of accountability for multiple workflows. For companies that are ready to overhaul or digitize their operations, this model is often the most effective path forward.

Staff Augmentation & Hybrid BPO

This model supplements your internal team with external resources. It works well for companies needing to scale seasonally, support new initiatives, or experimenting with outsourcing while maintaining in-house control.

Staff augmentation is a great option for bridging talent gaps. Let’s say your team doesn’t have compliance expertise or can’t provide multilingual support, a hybrid model can help you plug those holes without the long-term hiring commitment.

Hybrid models are suitable for companies in the midst of a transformation, where some processes are ready for outsourcing and others are still being optimized in-house.

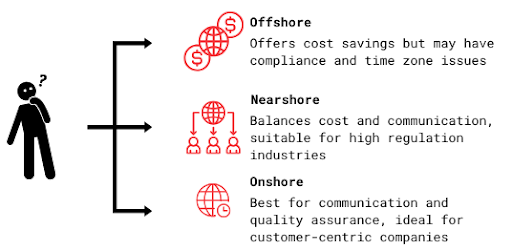

Offshore, Nearshore, and Onshore Options

Let’s talk about location. The business process outsourcing insurance industry has offshore, nearshore, and onshore options available and there are pros and cons for each. Offshore offers the best cost savings, but can raise compliance or time-zone concerns. Nearshore and onshore models are going to have less issues with communication and quality assurance. Choosing a location will depend on your business needs and customer base.

Nearshore and onshore options are often more appealing to companies that work in industries with a lot of regulations or would prefer to communicate without major time zone differences. However, offshore models are more suitable for straightforward, high-volume processes like data entry or claims intake.

How to Choose the Right Insurance BPO Model

When you start looking for the right insurance BPO model, don’t just compare costs because your choice will have a ripple effect on your business goals, operational pain points, and culture. The model that you choose is going to impact your performance, compliance, and customer satisfaction, so to help guide you, let’s look at what you will need to evaluate, starting with your core business goals.

Aligning With Your Business Goals

The first step in finding the right partner is to clarify your goals. Here are a few basic concepts for goals to consider:

- Increase Efficiency

- Speed Up Growth

- Improve Customer Experience (CX)

- Reduce Speed To Market

Different BPO models will serve different strategic goals. If your priority is scalability, you need a model that can ramp up quickly to match market demands. If you are more focused on compliance and customer satisfaction, you need a partner that can match your standards and processes. If you’re entering new markets or launching new initiatives, speed and flexibility become even more important.

You need to be thinking beyond the short term. Your outsourcing model should solve today’s challenges and support your long-term goals. So you need to find a partner whose services and structure can grow and adapt with you.

Factors to Evaluate

When comparing BPO models and providers, it is important to assess several core areas that directly impact performance and your long-term success; especially if you plan to outsource insurance back office operations.

Service level agreements (SLAs) should clearly outline expectations around:

- Turnaround times

- Accuracy

- Response rates

This will help ensure consistent accountability. In addition, regulatory compliance is a critical factor because partners must meet strict standards such as HIPAA, SOC 2, and PCI to protect sensitive data and maintain industry credibility.

Technology integration is also essential. The BPO provider’s systems should align with your existing tech stack. This includes:

- Policy administration tools

- CRMs

- Claims software

Not being able to properly combine forces is going to cause a whole mess of disruptions and mistakes. So do yourself a favor and make sure to double or triple check that their software can work with you.

Lastly, scalability and flexibility matter. With things changing throughout the seasons, having an outsourcing partner can be a game changer. These providers are prepared to add agents or scale the team back down as needed. The best part? Service quality stays at the same high standard throughout these fluctuations.

Want to scale your business?

Global Response has a long track record of success in outsourcing customer service and call center operations. See what our team can do for you!

Case Study Examples

By understanding how different BPO models apply in the real world, you may get a better understanding of which model is right for your company.Below are three common scenarios, each mapped to a specific BPO model.

- A mid-size P&C carrier uses a Functional BPO model to outsource underwriting support tasks. This frees up internal underwriters to focus on complex risk assessments, while the outsourced team can provide consistent throughput on high-volume submissions.

- A fast-scaling Managing General Agent (MGA) adopts an End-to-End BPO model to outsource the full policy lifecycle. This solution allows the MGA to remain lean while supporting rapid expansion into new markets.

- A national health insurer deploys a Hybrid BPO model, blending offshore staff augmentation with in-house claims oversight. The offshore team handles routine claim intake and data entry, while internal staff manage complex adjudications and compliance.

Read more Global Response case studies here.

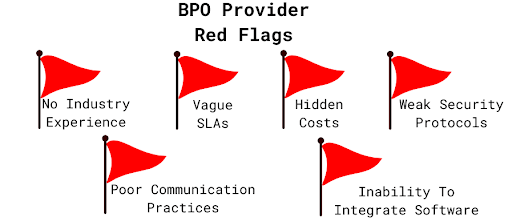

Red Flags to Watch for When Evaluating BPO Providers

While many BPO providers promise high performance and seamless integration, not all can deliver. Fortunately, we’ve mapped out all the red flags you need to look for early on in the evaluation process.

Common Pitfalls

Several warning signs often indicate future problems:

- Hidden Fees: Some providers will offer attractive base pricing, but tack on additional charges for essential services. Look for fees related to reporting system integration, and support. Make sure you always request a detailed breakdown of the costs.

- Vague SLAs: You want Service Level Agreements to be well defined and measurable. Overly general promises without quantifiable metrics is a sign they may not be a good fit.

- Data Privacy Gaps: Security and compliance are non-negotiable. A BPO partner lacking clear protocols around data protection, encryption, or audit readiness, is another sign this is not the right provider for your company.

Keep in mind, if something feels off, it probably is. We’ve included a complete list of all the red flags to look for below.

Questions to Ask Before Signing

Asking the right questions will reveal a lot about a provider. To get a better understanding of a provider’s values, capabilities, and readiness to support your business, ask:

- What KPIs do you guarantee? The right provider will clearly define how success is measured. As a bonus, you can also ask how often those KPIs are reported and how underperformance is handled.

- Do you support our core systems? This one is about integration. Confirm the BPO team has experience with your platforms and can easily adapt to your workflows.

- What’s your compliance posture? Ask about specific certifications and how often they conduct internal audits or third-party assessments.

These answers upfront are just what you need to weed out surface-level vendors and move forward with a true strategic partner.

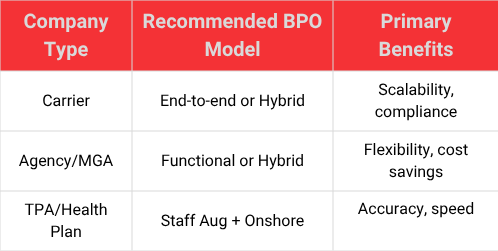

Final Checklist: Matching Model to Your Company Type

Unfortunately, there is no single “best” BPO model because it all depends on your company’s structure, scale, and operational priorities. However, we’ve made this guide for you to match your company type to the BPO model that typically delivers the most value:

AT Global Response, we help insurance teams simplify operations, stay compliant, and deliver better customer experiences. Let’s talk about how we can support your goals. Contact Global Response to get started.

Insurance BPO FAQs

Includes claims processing, underwriting support, policy administration, and customer service.

Evaluate expertise, regulatory compliance, tech compatibility, and SLAs.

Yes—if the provider is SOC2, HIPAA, or ISO-certified and uses secure infrastructure.

Lower operational costs, faster customer response, and access to skilled staff without hiring overhead.

Yes—modern providers support automation, analytics, and integration with core systems.

Offshore outsourcing is ideal for businesses seeking cost reduction, global expertise, after-hours and weekend support, or specific language capabilities.