BPO financial services drive real ROI for banks and credit unions by reducing costs, increasing efficiency, enhancing customer experience, and supporting digital transformation.

Read Time: 13 minutes

Table of Contents

Introduction

Financial institutions used to rely on business process outsourcing solely to cut costs, but now, third-party service providers are revolutionizing the industry, adding value to financial operations with powerful proactive strategies. Modern BPO drives measurable return on investment through digital transformation, compliance efficiency, and customer experience enhancements for banks and credit unions. Learn how to leverage BPO expertise, implement customer service best practices, and utilize cutting-edge technologies with the helpful tips in this article.

Key takeaways

- BPO financial services are not just about reducing overhead—they enhance operational scalability and CX.

- Strategic outsourcing helps banks and credit unions compete with fintech and neobanks.

- Real-world examples of ROI include increased customer retention, improved time-to-resolution, and compliance cost savings.

- Decision-makers should evaluate BPO partners on more than price. Consider CX, tech stack, regulatory expertise, and scalability.

Digital transformation is taking the world by storm, and the ever-evolving financial services industry must keep up. Net interest margins for the US banking industry are expected to decline in 2025, so it’s only natural for banks and credit unions to turn to outsourcing business processes to cut costs. However, to financial institutions’ benefit, long gone are the days when BPOs solely existed to answer phones at low prices. Now, they offer even more.

From digital-only banking to AI-personalized service and rising customer expectations, banks and credit unions are relying more on outsourced services not only as a cost-containment perk but also as a tool for long-term growth and sustainability.

Discover how BPO financial services go beyond cost saving to personalize banking in real-time, enhancing client relations and helping institutions prepare for more growth to come.

Why banks and credit unions need to rethink BPO

Financial organizations play a key role in customers’ everyday lives. Institutions not paying attention to user needs or behavior are missing out on vital opportunities for boosting satisfaction and increasing retention.

The highly competitive market demands top-quality service, and thankfully, contact center BPOs are the experts at customer care. Third-party providers connect businesses with vital support systems for enhanced operations:

- Agents experienced at navigating complex financial issues and situations in a variety of languages and cultural backgrounds

- Industry-leading technologies for greater compliance and enhanced self-service

- Experts ready to customize strategies to your institution

Customers also expect a streamlined, digital-first strategy:

- According to Salesforce, 86% of financial customers prefer to make account transfers digitally on their own.

- 68% prefer to update existing accounts digitally on their own,

- 68% prefer creating a personal budget digitally on their own,

- And 60% prefer to open a new account or policy digitally on their own.

- 59% of consumers turn to the web to ask a question and to deposit a check.

- 84% of consumers would switch financial service institutions if their data was mishandled.

Banks and credit unions excel in face-to-face service, and BPOs excel in implementing technology innovations to streamline self-service and facilitate virtual interactions.

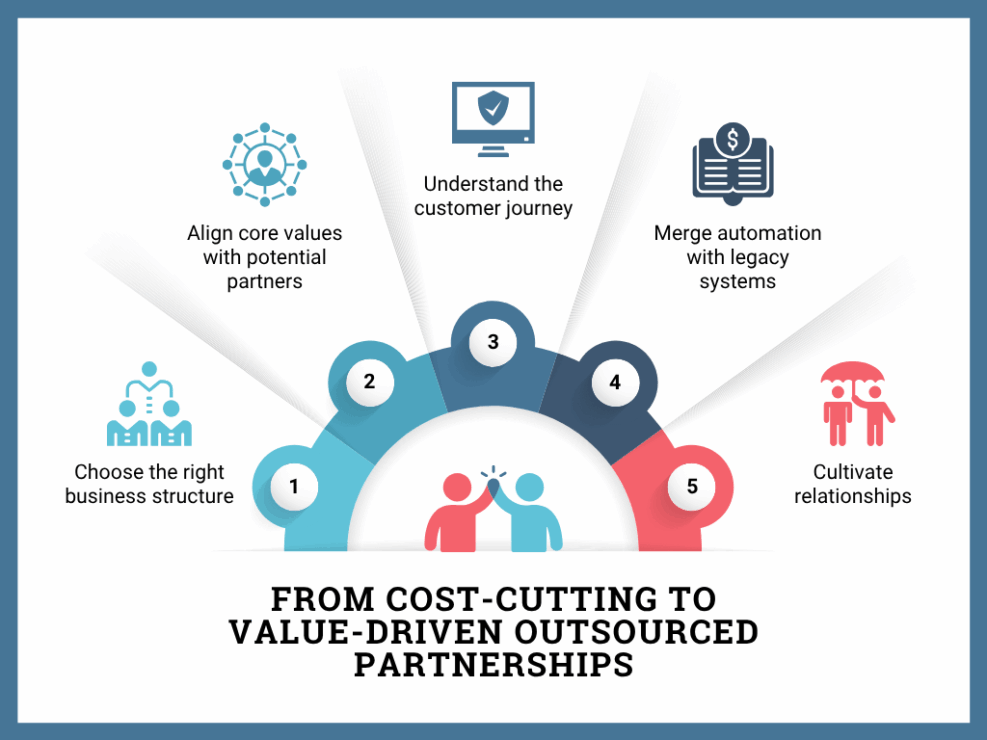

Shifting from cost-cutting to value-driven partnerships

Align core values. As the face of your company, your BPO contact center reflects your brand’s language, messaging, and tone. Immerse new agents in your culture, policies, and procedures to ensure your new partner is an extension of your brand rather than just an answering service. Consider using custom scripts for consistent high-quality service.

Understand the customer journey. A BPO expert should know how to map the customer experience and assist your audience through various processes. They can streamline training while increasing agent proficiency and confidence, empowering them through hands-on learning. Your new partner should also implement customer feedback loops, surveys, questionnaires, and real-time sentiment insights into strategies to address pain points with speed and efficiency.

Cultivate relationships. While self-service takes care of a host of pressing customer needs, financial audiences still crave personalized attention, prompt responses, expert assistance, and empathetic connections from their banks or credit union. Virtual contact centers can offer authentic relationships through personalized histories, tailored assistance, active listening, and streamlined escalations.

Want to scale your business?

Global Response has a long track record of success in outsourcing customer service and call center operations. See what our team can do for you!

Competitive pressures from fintech and neobanks

Financial technology platforms such such as neobanks are meeting the customers where they’re at: digitally, and often with low- or no-fee services. The convenience and affordable features they offer make them a lucrative option for customers, putting pressure on traditional banking institutions to step up their game.

But with different business models and regulations, traditional banks and credit unions can’t simply mimic fintech’s successful strategies. Instead, they should learn from them—their successes and limitations—to take back the competitive edge.

Convenience. On-the-go banking can handle a significant amount of banking needs, but neobanks often have pared-down services compared to traditional financial institutions. Neobanks handle checking and savings accounts, but don’t provide mortgages or loans.

To enhance convenience for your customers, optimize your online banking app experience, ATM prevalence and accessibility, and regular communications with your customers. Add value by educating where possible and anticipating needs through data-backed insights with a BPO provider.

Affordability. While your institution may not lower or waive fees the way fintech companies do, you can still offer a personalized experience that keeps customers loyal. Make online and mobile banking seamless and intuitive, provide tailored recommendations, and add a personal touch to stand out.

Banks and credit unions should also always keep an eye on their own bottom line to retain their competitive advantage. Streamline operations by partnering with a financial contact center BPO to reduce costs, embrace end-to-end digital transformation, and enhance customer experiences.

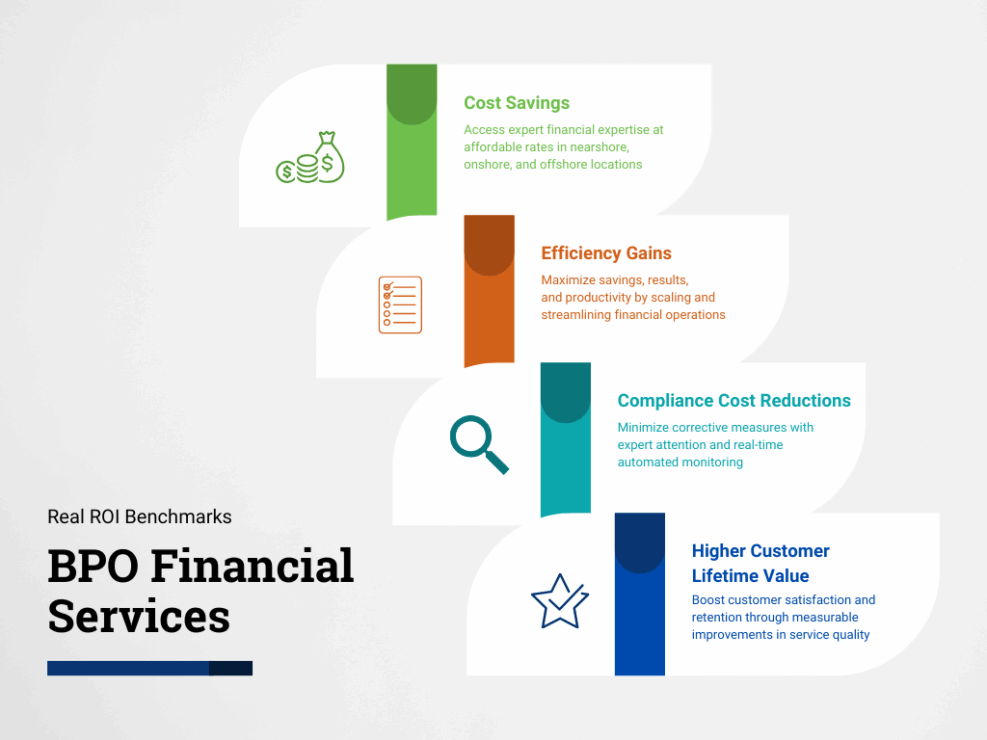

What real ROI looks like in BPO financial services

When you start looking at BPO services as more than just a cost-saving measure, it’s vital to measure the additional value outsourcing offers your company. Determine your return on investment for your outsourced financial services by considering these immediate and long-term tangible and intangible factors.

Cost savings

The most upfront benefit of outsourcing, reduced costs of building an internal support team save on direct labor, infrastructure, rent, and other overhead expenses. Compare these costs with the lump sum you’ll spend contracting with a third-party for expert service and industry connections providing a seamless takeover of all contact center operations.

Outsourcing ensures you hire expert teams from a selection of nearshore, onshore, and offshore locations for the services you require. Flexible providers should offer custom solutions at a variety of price points to help you find your match.

The classic ROI formula can help you make compare the costs:

ROI = [(Total benefits – total costs) / Total costs] x 100

Operational efficiency gains beyond the bottom line

Efficiency is the name of the game in outsourcing, and it can revolutionize your profitability in more ways than one.

Streamlined operations. A contracted team reduces the overwhelm your internal staff would otherwise face answering support requests, empowering your team to focus on their daily tasks and enhancing operational efficiency on all sides of your business model.

Scalability. Your financial BPO provider should empower your business growth and provide custom solutions for your needs. Whether you require rapid scaling to accommodate unexpected demand surges or you would like to scale down your team to accommodate off-season lulls, flexibility will ensure you get the most bang for your buck in outsourcing.

Better results. Outsourcing providers use proven methods to offer custom care, streamlining workflows and continuously improving based on real-time data and feedback. These strategies allow your team to do more in less time, leading to higher productivity, faster project completion, and better business practices.

Compliance cost reductions through outsourcing expertise

Inefficient operations run higher risks of compliance errors, meaning your bank or credit union spends more time, money, and resources taking corrective action. Outsourced support powerfully mitigates risks by eliminating the confusion and allocating the work to experts experienced in handling issues with the utmost adherence to rules and regulations.

An expert outsourced partner can also reduce risks with the support of industry-leading technology. Real-time monitoring tracks conversations and flags potential issues for experts to address before they escalate.

Improved CX leading to higher customer lifetime value

As your partner fine-tunes all customer experience operations, you will see the results, both in service quality and in client behavior. This better value for customers leads to higher retention and more loyalty to your financial organization.

Quality improvements. Your financial BPO service provider should present a specific plan for reaching goals and addressing problem areas, along with clear steps for measuring progress.

Key performance indicators in customer support will include Average Handle Time, Average Speed of Answer, Hold Time, First-Call Resolution Rates, Quality Assurance scores, conversion and sales rates, and customer satisfaction scores. Contact centers use sophisticated tracking technology to measure these metrics in real-time, allowing a comprehensive view of efficiency improvements over time and data-informed insights for achieving measurable results.

Customer satisfaction and retention. Dedicated care means your customers receive consistent levels of prompt, high-quality service. Customers appreciate the improvements, trusting your bank or credit union more as their issues are resolved with security and care.

Use cases of BPO in financial institutions

BPO providers can take over customer support, but they should come with experience handling financial services for your specific area of expertise. Learn how outsourcing can be the right fit for you in each of these financial situations and purposes.

Customer support outsourcing for credit unions

Credit unions face particular challenges and competition from larger financial institutions and fintech companies. As a result, credit unions need to do more to increase efficiency and productivity while decreasing costs and providing exemplary service to their members.

Some specific labor-intensive but non-core functions can be important to outsource for their expensive internal costs:

- Mail intake

- Document management and fulfillment

- Customer service

- Underwriting and post-closing support

- Backup services

- Disaster recovery

- Operational continuity

Our tip: Elevate digital user experiences to stand out. Reduce service delivery challenges to offer consistent quality support. Enhance self-service options to support your team.

Back-office automation for loan processing

Loan lending automations process data faster and with fewer errors than manual processes, providing a better experience for customers. Reduce the waiting game from days to minutes with custom workflows, software integrations, and automated processes for lenders and borrowers.

Our tip: Find areas to automate by capturing the lending journey, from loan origination and loan applications to underwriting and final payments.

AML and KYC as a managed service

Protect your customers and your financial institution by optimizing your strategies to prevent financial crimes. Work with financial outsourcing providers who securely handle all data and follow strict guidelines and implement best practices. Start with AML and KYC.

Anti-Money Laundering (AML) is the broader framework financial organizations use to prevent money laundering and terrorism financing.

Know Your Customer (KYC) is a critical component of AML that focuses on collecting and verifying customer information.

Your outsourcing provider should set up a clear process to assess risks, identify customer information, and monitor activity. Define strict roles and responsibilities to ensure utmost compliance. Analyze reports regularly to find insights with transparency.

Choosing the right BPO partner for strategic ROI

As outsourcing expands from a cost-saving measure to a value-providing partnership, your choice in a BPO provider is more important than ever. Select a partner capable of providing the results you seek by following these steps.

- Define clear objectives and expectations for the partnership.

- What problem points do you need to address? What are your long-term goals? What relevant services do they offer that you haven’t considered for your financial institution?

- Build strong communication channels.

- Regular communication should cover progress, challenges, adapting measures, and problem-solving efforts.

- Be technology-forward.

- Enhance self-service options. Demo programs for recruiting and training, call monitoring and guidance, quality assurance, workforce management, and more. Consider how each integrates with your existing tech stack for a seamless transition.

- Assess risk management and compliance policies.

- Their strategy should be aggressive and results-driven, fully compliant with all relevant rules and regulations.

Tech-forward vendors vs. legacy providers

Legacy systems are so named because they are critical to day-to-day operations, outdated as their technologies may be. Striking the right balance between pushing the envelope in technology-forward processes and capturing new insights in legacy applications is the goal for any financial organization. Evaluate the challenges and benefits of each to find your ideal approach.

Technology-forward vendors process, monitor, and streamline operations automatically, reducing risks and improving key performance metrics. Outsourcing key business processes saves your business significant resources and offers greater agility and scalability, as well as financial expertise and access to global financial markets. Tech-forward vendors should be aware of these risks of over-reliance on automation:

- Lack of accountability or context in errors or complex situations

- No nuance in decision-making

- Security vulnerabilities

- Customer experience breakdowns

Legacy providers rely on the expertise of employees who are well-versed in company culture and comfortable developing personal relationships and handling situations with nuance. Still, without an openness to change, outdated and time-intensive manual processes impact customer experiences and company profitability.

Neither option is perfect on its own, but a combination of each strategy’s selling points can put you on the path to success in a rapidly evolving digital banking landscape. Modernize legacy systems to preserve key knowledge while updating functionality to reduce costs and risks.

KPIs for measuring BPO value in financial institutions

Above, we mentioned key performance indicators to track for general customer support efforts. Customize your KPIs with your financial BPO to target these critical performance metrics:

- Client Fulfillment (CSAT)

- Call Determination (FCR)

- Call Forsake Rate

- Net Promoter Score (NPS)

- Worker Engagement Score

- Normal Handle Time (AHT)

- Whittling Down Rate

- Average Time to Close

- New Account Setup Error Rate

- Accounts Opened With Insufficient Documentation

- Sales Per Branch

- Total Volume Of Accounts managed by teams or individuals

- Number Of Workflow Processes Implemented

And many more! Collaborate with your BPO to fine-tune your metrics.

READ MORE: KPIs for call centers: 8 critical metrics to track

Real-world outcomes: Fintech case study

How a FinTech partner tripled their conversion rates

This company sought a BPO partner capable of perfecting the company’s brand messaging and delighting customers. They turned to Global Response, who built a plan that reflected the company’s innovative branding and focused on attracting customers and boosting sales. Previous contact center solutions failed to deliver the conversion rates the company sought, complicating messaging and confusing customers.

Global Response transformed the company’s customer experience management with efficient call flows, targeted messaging, improved contact workflows, and streamlined communication. The team helped the company reduce calls from ineligible customers, empowering them to focus more closely on eligible customers and strengthen relationships.

Conclusion

The transforming digital landscape is upsetting industries but pushing businesses to engage more meaningfully with customers than ever before.

The need for a strategic BPO approach has never been higher for financial institutions, and it may only continue to grow.

Collaborate with an outsourcing expert to proactively optimize your customer engagement strategies for sustainable success.

Leverage the expertise of a constantly adapting resource that learns from historical and current industry-wide successes to stay ahead of the curve.

Evaluate or pilot a high-ROI BPO engagement plan to capture value from outsourced financial services.